How to get amazon w2 former employee.

If you’re an employee, the annual tax season can often be a stressful time. One of the key documents you need is your W2 form, which outlines your earnings and taxes paid throughou...

Social Security Number (9 digits with no dashes) Date of Birth (must be formatted exactly MM-DD-YYYY including dashes and two digits for month and date and four digits for year example: 01-01-19XX) Once the registration steps are complete, select Access Current Year-End Statements menu to print and/or download your W-2.”.If you’re a homeowner, one of the expenses that you have to pay on a regular basis is your property taxes. A tax appraisal influences the amount of your property taxes. Here’s what...My last day was Dec 26. I wanted to download my W2 to get a head start on tax season. Archived post. New comments cannot be posted and votes cannot be cast. It will be mailed to the last address the company had on file for you. That’s what I gathered from all I found out. I was just hoping to get it online early. Thanks!If you file without the form W-2, the IRS will not be able to process your application. So, it is necessary to get the Bath and Body Works form. Detailed aspects of a W2 form. The W-2 form, also called the Wage and Tax Statement includes information about the taxes withheld and an employee’s wages in a year.Target sent me a copy of my w2 a few months ago and I unfortunately misplaced it, I can't sign into workday because my account has been deactivated and every time I try calling hr or corporate, they say they're closed even though I always call during business hours.

My last day was Dec 26. I wanted to download my W2 to get a head start on tax season. Archived post. New comments cannot be posted and votes cannot be cast. It will be mailed to the last address the company had on file for you. That’s what I gathered from all I found out. I was just hoping to get it online early. Thanks!

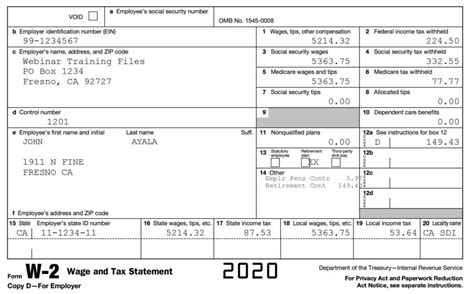

Page Last Reviewed or Updated: 29-Jan-2024. Information about Form W-2, Wage and Tax Statement, including recent updates, related forms and instructions on how to file. Form W-2 is filed by employers to report wages, tips, and other compensation paid to employees as well as FICA and withheld income taxes.I believe you can open a new account on ADP and access your info that. I've heard this from others but have no experience doing it. Reply. gettheyayo909. •. Yeah my former employer used ADP so when I set up my Amazon one it had my old check stubs on there. Reply More replies. true.

Alex_Masterson13. •. IF you received a paycheck, even if no taxes were taken out, they still are required by law to get you a W2. If it was not mailed to you, then it is probably sitting in the safe at the location you worked. You will just have to go there in person and ask for it. Reply.Form 1099-NEC is used to report nonemployee compensation (e.g. service income) to U.S. payees. Form 1099-NEC is replacing the use of Form 1099-MISC. If you are a U.S. payee and received nonemployee compensation totaling $600 or more, Amazon is required to provide you a 1099-NEC form as well as report these amounts to the IRS.Step 1: Access the Amazon A to Z Portal. To access your W2 form, you will need to log in to the Amazon A to Z portal. This portal is an excellent resource for Amazon employees and provides access to important information such as paystubs, benefits, and tax documents. Step 1.1: Create an Account.If you are an employee of Amazon, you should receive a W2 form from Amazon by January 31st of each year. The W2 form will summarize your earnings and tax …

A Dayforce W2 form is a tax form that provides information on an employee’s earnings and taxes withheld during a calendar year. Employees use it to file their federal and state income tax returns. An employer issues the form, which summarizes an employee’s earnings, withholdings, and other tax-related information.

Get Form W-2 As A Former Employee. As a former employee of Amazon navigating the intricacies of obtaining your Form W-2, the following options are available to facilitate a seamless process for filing last year’s tax returns, even if you are no longer employed by Amazon. 1.

Oct 19, 2023 · Answer. Yes, but an actual copy of your Form W-2 is only available if you submitted it with a paper tax return: Transcript. You can get a wage and income transcript, containing the Federal tax information your employer reported to the Social Security Administration (SSA), by visiting our Get Your Tax Record page. W-2 Forms. Your Form W-2, to be used in the preparation of your annual Federal and State Income tax returns, will be mailed/distributed by January 31, as per legal requirement by the IRS. If you have not received your W-2 by the second week of February, please contact the Payroll Office via email or phone (603) 646-2697.1. Await Mailed W-2 Form: Primarily, anticipate the delivery of your W-2 form by the company to the mailing address you provided. Accounting for mailing service timelines, …Yes, of course you can get a copy of your W2's all you need to do is go into Integrity Staffing Solutions and ask for your W2's. They will help you, which you need to type your name and social security number on a computer and print your W2's which you'll receive and you'll be on your way. Have a good day.Step 1: Check Your Email. The first place to look for your W2 from Amazon Flex is in your email inbox. Amazon Flex will send an email to all employees who have …

To access a digital copy of your form, please follow these steps: Log in to Amazon Associates Hover over your email address displayed in the top right corner, and select Account Settings.https://www.etax.com/ If you are an employee of Amazon, you should receive a W2 form from Amazon by January 31st of each year. The W2 form will summarize your earnings and tax withholdings for the ...Page Last Reviewed or Updated: 29-Jan-2024. Information about Form W-2, Wage and Tax Statement, including recent updates, related forms and instructions on how to file. Form W-2 is filed by employers to report wages, tips, and other compensation paid to employees as well as FICA and withheld income taxes.0go to www.mytaxform.com to get your w2. Search walmart for your employer and select 21-22 tax year. 1. Reply. Form 1099-NEC is used to report nonemployee compensation (e.g. service income) to U.S. payees. Form 1099-NEC is replacing the use of Form 1099-MISC. If you are a U.S. payee and received nonemployee compensation totaling $600 or more, Amazon is required to provide you a 1099-NEC form as well as report these amounts to the IRS. Aug 6, 2019 · This item Blank W2 Forms, 2023 4 Up W2 Tax Forms, 100 Employee Forms, Designed for QuickBooks and Accounting Software, Ideal for E-Filing, Works with Laser or Inkjet Printers, 100 Four Part Forms NextDayLabels - (1 Pack - 100 Sheets) W-2 4-Up Employee Tax Forms, Instructions on Back" for 2023, for Laser/Inkjet Printer.

I quit my job in may of 2023 and have since moved to a different address and I’m not sure how to get my W2. I started a forward but I sent myself a piece of test mail and I’ve verified that whoever is delivering the mail at my old house isn’t forwarding any of my mail.EY 2. I left KPMG in 2018. They mail it to your last address on file. You can contact HRSC 1-888-ONE-4772 (663-4772) to update the address if needed. Usually mailed by January 31. If you don’t receive by mid-February, you can contact customer service 1-800-642-5764 to request a W-2 reprint. Like.

Go to myloweslife.com, there's a link on the right side that says former associate. Click on that it has a pdf that tells you how to get your w-2. I got an email yesterday from mytaxform with information on how to get my W2. I checked into the company, apparently they're a subsidiary of Equifax that companies like Lowes and Walmart use to do ...Go to Federal>Wages & Income to enter a W-2. After you enter the first one, you click Add Another W-2. W-2's come from your employer, and they have until January 31 to issue it. Some employers allow you to import the W-2 through the software, but for security reasons you still need information from the actual W-2 to import it.Ex-employee as well - you will have to wait for it to be mailed to you - there is no way to access it online. Hubby still works there and I had him ask his ATL (my former ATL) and she confirmed. FYI: All W-2s (regardless of company) must be delivered to employees by Jan 31st. 2. Reply.January 22, 2018 by Alhamdulillah. Bass Pro Shops Employee W2 Form – Form W-2, also known as the Wage and Tax Statement, is the document a company is required to send out to each employee and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports workers’ annual incomes and the amount of taxes kept from their incomes.A subreddit for current, former and potential Amazon employees to discuss and connect. If you have any questions, comments or feedback regarding the subreddit, please feel free …How to get W2 from safeway for tax year 2023. https://my.adp.com. Call Safeway, give them your new address, ask them to send you another W2. my.adp.com. I found my Ross W2 there a year after I had left them, as well as my current Safeway W2. You can also call the payroll number and let them know you are a former employee and need your W2.W2 Process for Former Employees. For former employees of The Cheesecake Factory, the process to access past W2s is fairly straightforward. To get your past W2s, you first need to update your address with the company so they can send you the necessary documents. This can be done by contacting the Human Resources …Amazon operates a website called AmazonSmile that’s just like Amazon.com with the same products, prices and information. Amazon customers who use AmazonSmile enjoy having a choice ...Welcome to our community, a place where customers and employees can share their appreciation and experiences at Chipotle Mexican Grill on this unofficial fan forum. Members Online Question for a manager about w2.

A subreddit for current, former and potential Amazon employees to discuss and connect. If you have any questions, comments or feedback regarding the subreddit, please feel free to send us a message through modmail. Please note: We are not a customer support subreddit, please reach out to appropriate contact points for assistance with your order.

Go to Paycom's Employee Self-Service ® portal. Log in and click "My Payroll." Then click "Year-End Tax Forms." If you do not have access to Paycom's Employee Self-Service ® portal, contact your company's HR/payroll personnel for this form. If you are having trouble logging in, contact your company's HR/payroll personnel.

If you’re an employee, the annual tax season can often be a stressful time. One of the key documents you need is your W2 form, which outlines your earnings and taxes paid throughou...First, you can easily access your W2 form online through the Pizza Hut employee website. Simply log in to your account and navigate to the section for tax forms. From there, you should be able to view and download your W2 form for the current tax year. If you no longer have access to your online account, or if you encounter any issues with ...Go to Federal>Wages & Income to enter a W-2. After you enter the first one, you click Add Another W-2. W-2's come from your employer, and they have until February 1 to issue it. Some employers allow you to import the W-2 through the software, but for security reasons you still need information from the actual W-2 to import it.Oct 19, 2023 · Answer. Yes, but an actual copy of your Form W-2 is only available if you submitted it with a paper tax return: Transcript. You can get a wage and income transcript, containing the Federal tax information your employer reported to the Social Security Administration (SSA), by visiting our Get Your Tax Record page. Jan 23, 2024 · Visit the Walmart OneWire Portal: Upon leaving Walmart, you can still access your W2 form through the OneWire portal, which serves as a centralized platform for current and former Walmart employees. By navigating to the designated website, you can initiate the process of retrieving your W2 form, demonstrating Walmart's commitment to providing ... Hello, thanks for reaching out. You’ll need to create a former employee Global Logon in order to access. Please follow the instructions below. Create a former employee Global Logon if already off payroll (this process requires a One-Time PIN): 1. Request PIN at HR OneStop 1-888-722- 1787 and say "Former Employee Site" 8 a.m. …This is an unofficial forum for USPS employees, customers, and anyone else to discuss the USPS and USPS related topics. WE ARE NOT USPS CUSTOMER SERVICE - CUSTOMER SUPPORT QUESTIONS ARE NOT ALLOWED - please seek assistance from the US Postal Service for all package inquiries.Note: Since your browser does not support JavaScript, you must press the Resume button once to proceed.

Former employee trying to get w2. Closed. Hi. I am a former employee having quit in January of 2021. I am concerned about my W2 because I have no access to a portal to retrieve it, and haven't gotten an email. I also have since moved and there is a mail forwarding in place, but as of 2/1/22 I haven't received anything regarding my W2.Key Takeaways. – To get your Amazon Flex W2, log in to your Amazon account and go to the “Tax Center” page. – Amazon Flex W2s are usually available in early February. – If you did not receive your W2, contact Amazon customer service for assistance. In conclusion, retrieving your Amazon Flex W2 is a straightforward process.2023 IRS Tax Form W2 4UP Employee's Copy B,C,2,2 Combined ... ←Previous; Next→. Close. Show 17 results ... Find a Gift · Browsing History · Returns · Disab...Instagram:https://instagram. how much is elitch gardens season passesmovie showtimes appletonrikers island music videoadmonishment from austin powers crossword clue How To Get Form W-2 As A Former Employee of Amazon? What if Amazon was your prior employer? What if you want to file last year’s tax returns and are no longer working at Amazon? As an ex-employee of Amazon, you can get access to your form W-2 by contacting the company’s payroll department.Help. Contact the HR Service Center if you need assistance with the online system. 1.888.894.4747. 1.866.839.2747 for TTY. Contact Texas Health and Human Services Payroll if you left HHS more than 24 months ago. [email protected]. 512.706.7355 FAX. moose lodge annapoliskellen schermerhorn Ryder Employee W2 Form – Form W-2, also referred to as the Wage and Tax Statement, is the document a company is required to send to each worker and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports employees’ yearly incomes and the quantity of taxes kept from their paychecks. A W-2 worker is somebody … For Amazon workers, receiving their W-2 shouldn’t be an issue, but for former employees or soon-to-be-former employees, make sure to try to get it before you leave. But, the Internal Revenue Service sets the deadline to file these tax forms January 31st, the following year. So there is a big chance that you’ll get it after the tax year ends. kenmore top load washer manual Alex_Masterson13. •. IF you received a paycheck, even if no taxes were taken out, they still are required by law to get you a W2. If it was not mailed to you, then it is probably sitting in the safe at the location you worked. You will just have to go there in person and ask for it. Reply.For a copy the 2019 W-2, contact the Amazon personal department. “W2” commonly refers to a type of tax form used in the United States to report an employee’s wages and tax withholding information to the Internal Revenue Service (IRS).It is possible that Amazon, like many other employers, issues W2 forms to its employees each year …